The Future of Office…Or the Office of the Future?

John McCarthy, CEO, Starwood Real Estate Income Trust

COVID-19 has brought great uncertainty and change, which has impacted virtually every aspect of our daily lives. It has profoundly affected the global economy, including business, healthcare, education, travel, government and naturally where and how we work. Some of the changes brought by COVID-19 will have a lasting effect and some will be more temporary. Determining which changes will last will be challenging, but necessary to be prepared for what lies ahead.

This article specifically addresses the changes COVID-19 has brought to “how and where we work” and its impact on office properties. Even before COVID-19, there was a movement across the U.S. workforce to work more from home. The Federal Reserve estimates that work from home has tripled over the last 15 years. This change has been driven largely by the high cost of living in many dense urban areas which extends commuting times, along with an increase in the quality of technology which allows for better remote collaboration.

As COVID-19 fades, many aspects of working in offices will return to what they were, but the need for flexibility will create potential winners and losers. We know employees will want greater flexibility and better accommodations. We will focus on the drivers of this potential change. Some will be positive for office demand, while others may be negative.

Potential Changes Impacting Demand for Office:

1. Work from Home Decreases the Demand for Office: When COVID-19 forced a substantial portion of the U.S. workforce to shelter in place and work from home, it forced employees and managers alike to test the theory that workers could be productive working from home. By almost all accounts, the forced experiment has resulted in greater comfort with employee productivity while working remotely. The obvious extension of this is less demand for office space, as certain workers are offered the flexibility to regularly or periodically work from home.

Important questions remain: What kinds of work can be done at home? Reports have indicated close to 40% of all jobs could plausibly be done at home. That leads to another question: How many actually want to work from home? A recent survey by Gensler Research (“Gensler U.S. Work from Home Survey 2020”) determined only 12% of office workers want to work from home. Several studies suggest after many months of working from home, employees miss the daily interaction with their coworkers and having specific working hours. The Gensler Survey indicated 74% of respondents say the people is what they miss most about the office. Whatever the eventual outcome, we know that some portion of the workforce will have permanent or periodic flexibility to work from home, which may negatively impact future demand for office.

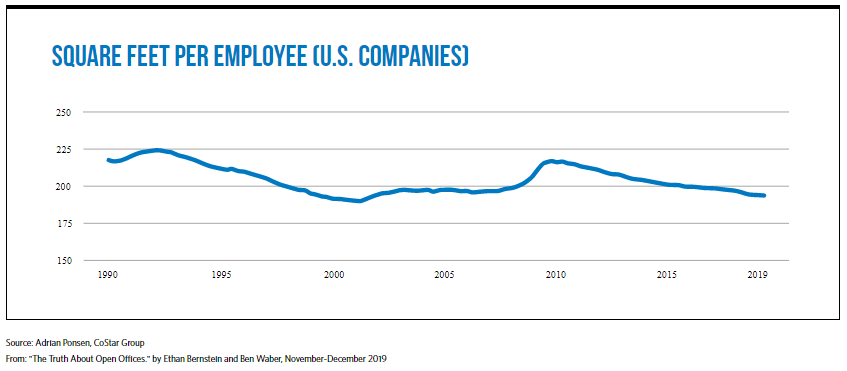

2. Reversal of Densification: Of the factors effecting demand and usage of office space, the one that may be the least controversial is the densification of office space that has occurred over the past 20 years will reverse. Social distancing and the need for generally more distance between employees requires more space, more elevators, and larger common areas.

Office space peaked at around 225 square feet (“s.f.”) per employee in the early 1990s. That figure dropped to less than 200 s.f. per employee by 2019, approx. a 15% decline. By way of example, if New York City or Boston de-densify just to 1990s level of 225 s.f. per person, it would require 86 million and 12 million s.f. of new leasing, respectively. That’s a lot of leasing. It seems clear that de-densification will increase the demand for office space.

3. Flexible Spoke and Hub Office: Employers will de-centralize and offer more flexible work locations: Flexible suburban work locations may never fully replace urban locations, but we believe employees will expect more flexibility from their work locations in the future. Having enjoyed zero length commutes, employees will demand work locations that offer shorter commutes and properties that assure a greater level of health and wellness. A recent study suggests that pre-COVID-19, the average commute in the U.S. had reached 27 minutes each way, and traditional big city urban centers often demand commutes far longer. Workers, post COVID-19, will be less tolerant of longer, inconvenient commutes, especially if they involve over-crowded mass transit and poor quality office product.

This suggests employers, especially larger employers, will identify strategically located satellite locations where employees can shorten commute times, have access to better open spaces, more elevators and enjoy an overall higher quality work experience. This suggests the demand for office may increase as satellite locations are added to central office hub locations.

4. Quality Counts: In the post-COVID-19 future we believe both employers and workers will demand better quality accommodation with features like high floor to ceiling ratios, large amounts of natural light, operable windows, higher quality air purification and circulation, larger more useful common areas, higher elevator counts, separate entrances, private outdoor spaces and better floorplates. We believe this increased demand will result in a premium being placed on higher quality locations and properties.

5. Cracks Emerging in Work from Home: Now that work from home has been occurring for a period of time, cracks are starting to show: Work takes longer, hiring and training new staff is challenging, younger professionals may not be assimilating to company culture or embracing company values, and mental health issues are becoming discussed more frequently as the lines between work and personal life become blurred.

During the COVID-19 lockdown, employees who were asked to work from home benefitted from the pre-existing relationships that were developed… in the office. We believe the spontaneous interaction between employees, which occurs in the office, is critical towards developing trusting co-worker relationships, and ultimately in-person interaction is how company values and culture are learned.

Consider a 2019 study completed by a Fortune 500 firm, which concluded that just 10% of all employee communications occurred between employees whose desks were more than 50 feet apart. Another study completed at a technology firm indicated remote workers communicated 80% less about their assignments than co-located team members did. In 17% of the projects measured, non-co-located team members didn’t communicate at all.

We believe during COVID-19, senior managers will allow flexibility for employees to work from home for a period of time for safety, but will not likely emerge as managers or business owners preferred long term solution. This may mitigate the ultimate impact of work from home.

Final Observations:

The push and pull of these factors on office will not be clear for some time. In the interim, new construction of office space will materially slow or cease across the U.S. until the outcome becomes clearer. We believe the higher quality properties with more flexible floor plans will have an advantage. As employers look to rationalize their office footprint, we are certain they will favor more affordable, low cost markets where workers can enjoy a high standard of living, with generally shorter commute times. Ultimately, certain firms may reduce their office footprint, while others take more space to lessen worker density. Employers may also offer additional satellite locations for workers to shorten commutes and increase flexibility. Post COVID-19, employees will expect to return to a different workplace with more space, less desk sharing and increased technological support to enable flexible work from home.

During the evolution to this “new normal” we believe (a) over the long run, job growth will create incremental demand for office space, (b) an outsized portion of that job growth will be in affordable, low tax / low cost markets, (c) higher quality, Class A properties will capture an outsized portion of demand, and (d) those properties with long in-place leases will provide a strong performance buffer and serve to protect investment value.