SERVICES

Wealth Management

We empower clients by offering comprehensive financial planning and investment services individually tailored to client needs. We work with clients to develop an Investment Policy Statement which outlines a long-term strategy that strives to build and preserve their wealth.

Investment Policy Statement

We construct an Investment Policy Statement for every client to provide the following:

- Establish a clear understanding of the client’s goals and objectives

- Report client risk evaluation results and summarize investment philosophy

- Offer guidance regarding the investment of assets incorporating your risk considerations, tax issues and time horizon

- Identify recommended target asset allocations, establishing a long-term approach

- Establish a basis for evaluating investment results

- Define monitoring procedures— rebalancing procedures, quarterly portfolio reporting and client meetings

Portfolio Management

We have one of the most versatile portfolio management platforms nationwide. Portfolio management is offered utilizing the institutional investment platforms of Charles Schwab & Co., Fidelity Investments, TD Ameritrade, and Interactive Brokers.

Our Model Portfolios are designed to emphasize market segments of higher expected returns, minimize turnover and reduce overall expenses. Model Portfolios can be used as core strategies or as building blocks to create the ideal portfolio for the client. Detailed information for each Model Portfolio can be found on our Model Folio page, including holdings, model allocation, benchmark allocation and historical performance published monthly.

Risk Evaluation

Built on a Nobel Prize-winning framework, we provide a risk evaluation for each client using our risk alignment tool that quantifies the semantics of the financial advice industry, replacing confusing and subjective terms like “moderately conservative” and “moderately aggressive” with the risk number, a number between 1 and 99 that pinpoints a client’s exact comfort zone for downside risk and potential upside gain. We then build an investment portfolio to match the client’s risk number and chart a clearly defined path to the client’s goals.

HOW IT WORKS:

Capture Your Risk Number – The first step is to answer a 5-minute questionnaire that covers topics such as portfolio size, top financial goals, and what you’re willing to risk for potential gains. Then we’ll pinpoint your exact Risk Number to guide our decision making process.

Align Your Portfolio – After pinpointing your risk number, we’ll craft a portfolio that aligns with your personal preferences and priorities, allowing you to feel comfortable with your expected outcomes. The resulting proposed portfolio will include projections for the potential gains and losses we should expect over time.

Portfolio Rebalancing

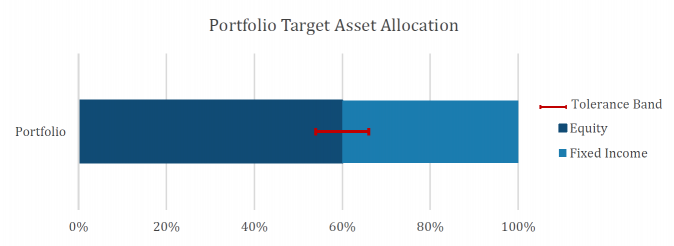

We utilize a tolerance-based system for rebalancing when a position deviates too far from its target allocation. The tolerance-based system uses tolerance bands based on a specific percentage, typically 10% for major asset classes. The chart below shows an example of a portfolio allocated to 60% equities. The portfolio would only require equity rebalancing if the equity allocation exceeded the tolerance band threshold by either increasing to 66% or decreasing to 54% of the portfolio allocation.

These rebalancing procedures also apply to sub-asset classes (20% tolerance band) in the allocation and our monitored daily by our portfolio management system. Typically, minor rebalancing is only necessary once every 9 to 12 months and does not cause significant capital gains issues.

Performance Reports

We provide all clients quarterly performance reports through the their online web portal. Please see the sample provided below. Our performance reports are generated utilizing industry recognized Morningstar Office software. Performance of your accounts will be compared to a comparative benchmark index using the appropriate major indices. We also provide other types of reports at the request of the client.