What Happens When You Fail at Market Timing

It’s hard to predict the best days in the markets, and the cost of missing them can be high.

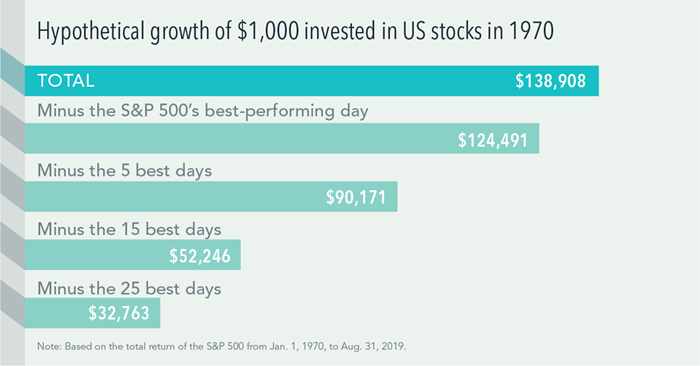

The impact of missing just a few of the market’s best days can be profound, as this look at a hypothetical investment in the stocks that make up the S&P 500 Index shows. A hypothetical $1,000 turns into $138,908 from 1970 through the end of August 2019. Miss the S&P 500’s five best days and that’s $90,171. Miss the 25 best days and the return dwindles to $32,763. There’s no proven way to time the market—targeting the best days or moving to the sidelines to avoid the worst—so history argues for staying put through good times and bad. Investing for the long term helps to ensure that you’re in the position to capture what the market has to offer.