Factor Investing

What Are Factors?

A factor is any characteristic that helps explain the long-term risk and return performance of an asset class. Factors are well documented in academic research and have been used extensively in portfolio risk models and in quantitative investment strategies. These are the same variables that active fund managers have used in their security selection and portfolio construction process.

Factor investing is not new; it has long been used in quantitative investment strategies. Factor investing seeks to capture higher risk adjusted returns via systematic exposure to stock characteristics. Over the years, both the academic world and the investment industry have identified 6 individual factors that have historically delivered out-performance relative to the broad stock market.

How Are Factors Defined?

Low Volatility: The inverse of volatility, a measure of the risk of an asset measured by the standard deviation of returns over a particular interval of time.

Dividend Yield: A measure of a company’s dividend relative to its underlying price.

Quality: A measure of balance sheet strength and earnings stability.

Momentum: A measure of recent strength in stock price behavior. Stocks that had positive excess returns in the recent past are grouped separately from those that displayed negative excess returns.

Value: A measure of how inexpensive a stock is relative to its fundamentals.

Low Size: A measure of the market capitalization of a company relative to companies in a given universe of stocks.

How Are Factors Screened?

Minimum Volatility: Volatility of each stock in the broad market index and correlations between stocks, sectors, and countries

Yield: Dividend yield

Quality: Return on equity (ROE), earnings consistency, and debt-to-equity (D/E) ratio

Momentum: Risk-adjusted price momentum

Value: Price-to-earnings (P/E) ratio, enterprise value to cash flow, and price-to-book (P/B) ratio

Size: Market capitalization

Why Construct a Portfolio Using Multiple Factors?

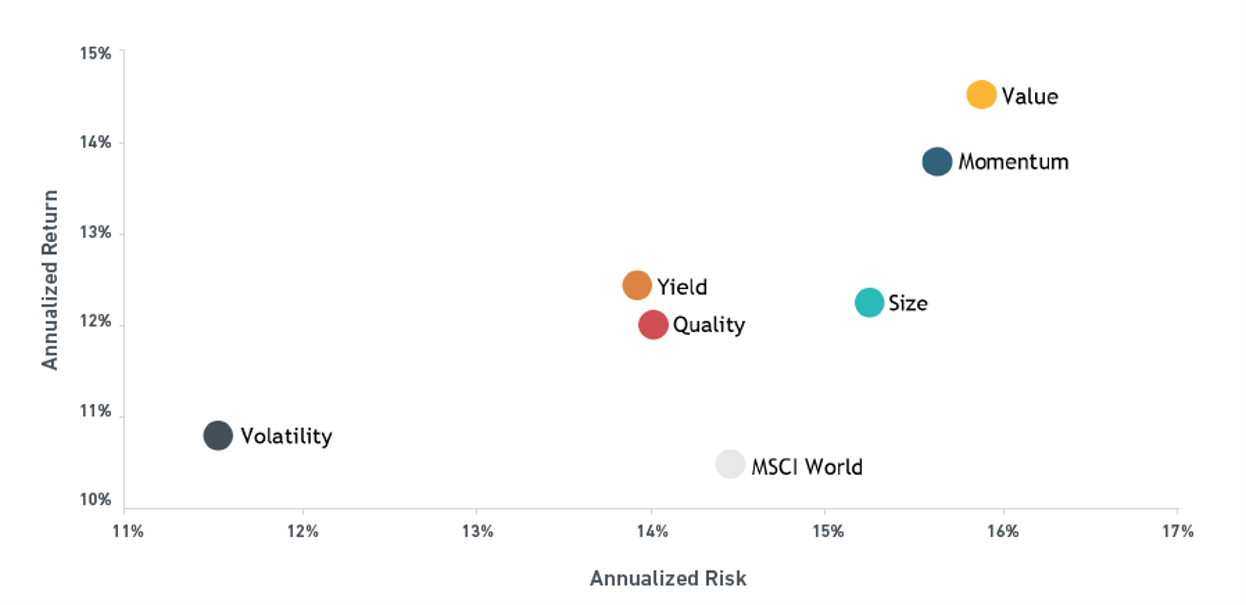

Research has shown that investing in a combination of factors historically has enhanced long-term returns relative to traditional market cap-weighted index fund portfolios. Also, tilting towards factors can improve risk-adjusted returns without reducing liquidity, investability, and diversification.

Factor performance changes over a business cycle. We obtain more diversified outcomes when we construct a portfolio harnessing different factors.

- Minimum volatility, yield and quality are considered “defensive” factors and tend to benefit during periods of economic contractions.

- Momentum is considered a “persistence” factor and tends to benefit during continued trends in markets.

- Value and size are considered “pro-cyclical” factors and tend to benefit during economic expansion.

FACTOR PERFORMANCE: JANUARY 1977 - DECEMBER 2019

Source: MSCI Inc.